Filling the education gap

The low rate of teenage financial literacy leads to poor financial decisions for the job ready.

Our program helps young people navigate:

- their first job

- their first pay check

- their first purchases

Set them on the path to lifelong financial resilience and success.

The need for education in financial literacy

The rate of financial literacy is very low and falling among young people.

Most students do not feel confident making simple financial decisions such as choosing a bank account.

This is despite governments here and internationally recognising young people as a critical cohort for education in financial literacy.

In contrast, young people entering the workforce have growing agency in financial decision making in an increasingly complex environment.

94% of 14 to 17 year old Australians want to know how to manage their money better.

The Money Mentor program is specifically designed to fill this gap.

Why choose the Money Mentor program?

Participant feedback

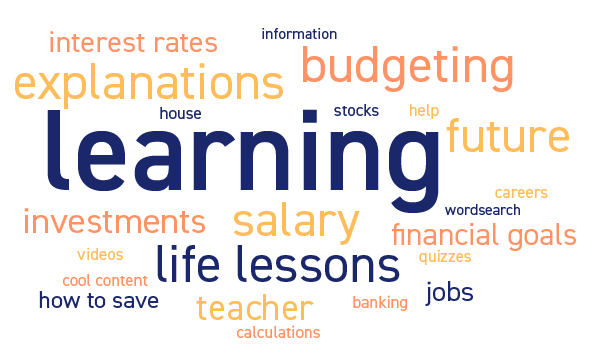

Some of our participants’ favourite things about the course.

What did you enjoy learning?